As it happened: Fall out from the ASIC report, wheat prices tumble, ASX closes higher

Reactions to the parliament's ASIC inquiry, a look at what's brought wheat prices down and the ASX closes trading higher

Follow the day's financial news and insights from our specialist business reporters on our live blog.

Disclaimer: this blog is not intended as investment advice.

Key events

To leave a comment on the blog, please log in or sign up for an ABC account.

Live updates

Markets wrap

By Emilia Terzon

- ASX 200: 1.19% to 7,831.8points

- Aussie dollar: +0.12% to 67.12 US cents

- Asia: Hang Seng: +0.17% Nikkei225: +0.82%

- Wall Street: Dow -0.1=06% S&P +0.51% Nasdaq +0.88%

- Europe: Stoxx 50 +1.2% FTSE +0.6% DAX +1.16% CAC +1.2%

- Gold: +0.04% to $US2355/oz

- Brent crude: -0.61% to $US83.27 a barrel

- Iron ore: +0.39% to $US113.7 a tonne

- Bitcoin: -1.1% to $US58,855

Prices current as of 1645 AEST.

Great day to be a mining stock

By Clint Jasper

West coast = best coast !

At close of trade today the ASX finished 91.9 points higher, up 1.19% at 7,831.80 - crossing above the 50-day moving average.

All 15 of the largest companies by market capitalisation — more than half of which are miners or banks — finished higher, with an index of the 20 biggest stocks adding 1.5%.

Among banks, Macquarie, Westpac, NAB, ANZ and Commonwealth rose by between 0.7% and 2.0%. The heavyweight materials sector gained 2.3% as iron-ore, lithium and gold stocks all rose.

BHP, Rio Tinto and Fortescue put on between 2.6% and 3.2%.

Elsewhere in the region, Reuters reports that:

- MSCI's broadest index of Asia-Pacific shares outside Japan rose 0.9% to reach its highest since April 2022.

- Japan's Nikkei climbed 0.9% to within spitting distance of its March peak, while the broader Topix clinched all-time highs.

- Taiwan's main index also struck a record led by the tech sector and Taiwan Semiconductor Manufacturing Co which cleared T$1,000 for the first time.

Aussie dollar surge

By Clint Jasper

Here's a more fleshed out take on the performance of the Australian dollar courtesy of Stella Qiu at Reuters:

The Australian dollar stood tall near a six-month high on Thursday, after cracking major resistance levels overnight as soft U.S. economic data fanned hopes of a September rate cut, supporting bonds.

The Aussie also made further gains on its New Zealand cousin and scaled a fresh 33-year peak versus the battered yen due to robust demand from carry trades — where traders borrow a currency with low interest rates to invest in a currency with higher yields.

The Australian dollar firmed 0.2% to $0.6718, having gained 0.6% overnight to as far as $0.6733, its highest level in six months. The currency also snapped the top-end of the recent trading range of $0.6714, helped by market wagers that the next move in local rates could be higher.

The kiwi dollar got a respite from recent selling pressures. It edged 0.1% higher to $0.6108, having climbed 0.4% overnight to as far as $0.6129, and bounced off its 200-day moving average at $0.6071.

Both currencies rallied after overnight data showed U.S. services sector contracted last month, with employment notably weak ahead of the June payrolls report due on Friday. Economists forecast an increase of 190,000 jobs in June after a jump of 272,000 in May.

"It (AUD) needs to see a sustained break above resistance at 0.6710/20, a development that it is closer to achieving and likely hinges on the outcome of tomorrow night's non-farm payrolls data," said Tony Sycamore, an analyst at IG.

Markets lifted the probability of a September rate cut from the U.S. Federal Reserve to 76%, from 65%. Back in Australia, investors pared back the risk of an interest rate hike in August to 20% from about 30% a day ago.

Still, the risk of further tightening in Australia contrasted with bets that rates in New Zealand will be lower this year. The Aussie climbed for seven consecutive sessions to NZ$1.0989, just below a seven-week top of $1.0998 hit on Wednesday.

Australian bonds rallied in tandem with U.S. Treasuries, but soon lost steam and ran into some selling pressures. Ten-year government bond futures YTCc1 gained as much as 8 ticks before settling at 95.585, up 2 ticks for the day.

The Aussie was fetching 108.37 yen, having hit a fresh 33-year high of 108.5 yen overnight, and the kiwi was trading at 98.58 yen, hovering near a 38-year top of 98.76 yen.

Book the trip!

By Clint Jasper

The Japanese Yen has fallen to a 33 year-low against the Australian dollar today ... meaning you'll have some good purchasing power in Japan at the moment.

Today, the Australian dollar rose off the back of trade data and commodity demand.

While the Yen has been in the doldrums for months now, recently hitting a 38-year low against the US dollar.

And it hit a record low against the Euro.

So now's probably as good a time as ever to book that trip to Japan - I hear its lovely in the spring!

The only warning I'd offer: you won't be the only one with this idea:

Balance of Payments decline in March quarter

By Clint Jasper

What happened to the balance of payments

- Ilia

The Australian Bureau of Statistics put out balance of payments data today (thanks for the reminder Ilia)!

"The current account balance (seasonally adjusted, current price) for March quarter 2024 was a deficit of $4.9b. This was a decrease of $7.6b from the revised December quarter 2023 current account surplus of $2.7b.

The current account deficit for March quarter 2024 reflects a smaller trade surplus on the balance of goods and services, while the net primary income deficit increased.

The balance on goods and services in seasonally adjusted chain volume terms is expected to detract 0.9 percentage points from the March quarter 2024 GDP quarterly movement.

The terms of trade increased 0.2% to 94.9, up from 94.7 in December quarter 2023.

The net primary income deficit increased to $22.3b, following the $20.8b deficit in December quarter 2023.

Australia's net international investment liability position was $730.3b at 31 March 2024, a decrease of $103.9b on the revised December quarter 2023 position of $834.2b."

Looking to offload that old clunker?

By Clint Jasper

The ABC's chief business correspondent, Ian Verrender says you may have missed the boat.

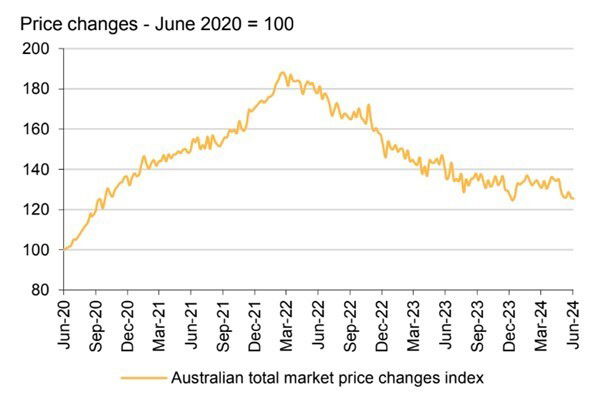

Some new research by Macquarie analysts suggests the used car market is coming off the boil as prices moderate after the post pandemic squeeze.

Shipping chaos in the aftermath of the pandemic restricted the supply of new vehicles, forcing many seeking a new chariot to look to the used car market.

End result? A price spike in early 2022.

It’s been a downhill run ever since although it seems the market has started to flatten. Used car prices remain about 20 per cent above the levels of four years ago but have only edged lower in the past 12 months.

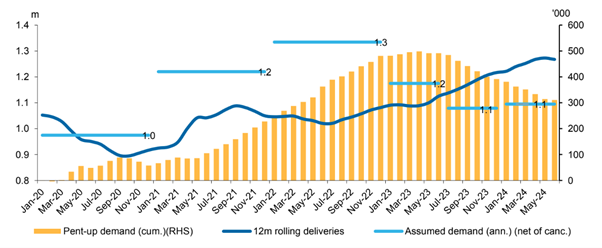

When it comes to new cars, there may be some relief in store for potential buyers.

New car sales volumes rose about 9 per cent in June but were down a touch on the same period last year with inventory levels on the rise. That’s prompted some price action among dealers and squeezed profit margins.

And the flow of new cars back into the system has helped alleviate pent up demand for new cars as this graph illustrates.

But you still have to wait to get a new vehicle.

Back in 2019, you could pick up a new car within three weeks of ordering it. That jumped to an average of 85 days or three months. And while that’s eased a little, you’re still looking at around 80 days, even for one of the most popular brands.

Maybe that explains why the average vehicle age has grown to more than 12 years.

Mining stocks rise as iron ore futures lift

By Clint Jasper

via Reuters:

Iron ore futures hit a one-month high, helped by robust near-term demand, improved steel fundamentals, and hopes of more stimulus from top consumer China.

Aussie mining stocks rise as much as 2.7% to their highest level since mid-June.

BHP shares climb as much as 2.8% to its highest level in a month.

Rio Tinto and Fortescue jump as much as 2.5% and 3.7%, respectively

Water market expected to tighten

By Clint Jasper

I hope everyone is having a smashing first week of the new financial year!

It's also the first week of the new year in trading for the water markets in the Murray-Darling Basin.

Last year, thanks to high rainfall across the valleys, we saw some very low allocation prices. Irrigators could essentially rely on rainfall, instead of purchasing irrigation water for their crops, so demand was low.

But in the entitlement market we're watching a future case study in economics about to play out in front of our eyes. Water entitlements are an on-going right to access water from a part of the southern Murray-Darling system.

The federal government intends to purchase water entitlements, to the tune of up to 765 gigalitres of water from the system, effectively meaning the supply of water for irrigation will reduce as those purchases are carried out before 2027 (although the government may not end up purchasing all of that volume).

But there's a baked in level of demand - because of a big expansion over the last decade in permanent plantings of almonds, table and wine grapes and citrus - particularly around the lower Murray.

Unlike cotton and rice crops, where grows can choose each year whether to plant, permanent crops can’t be switched off.

Now, the ACCC's Mick Keogh says those government buy backs will further drive up the cost or irrigation water in the Murray-Darling Basin, especially for those with in private irrigation networks.

"Over time a lot of the costs of maintaining an irrigation network are reasonably fixed," Mr Keogh told the Victorian Country Hour.

"If there's less volume moving through them, that increases the unit charge they need to apply to recover those costs."

Between the start of the Murray-Darling Basin Plan, in 2012, and its expected completion in 2027, a total of 2750 gigalitres should be available for the environment, and not used for irrigation.

To help illustrate the clear trend in entitlement prices, my go to chart comes from the team at Aither, they have a robust index of entitlement prices; where you can see the very clear rise in prices over the last decade:

Wild ride for wheat

By Clint Jasper

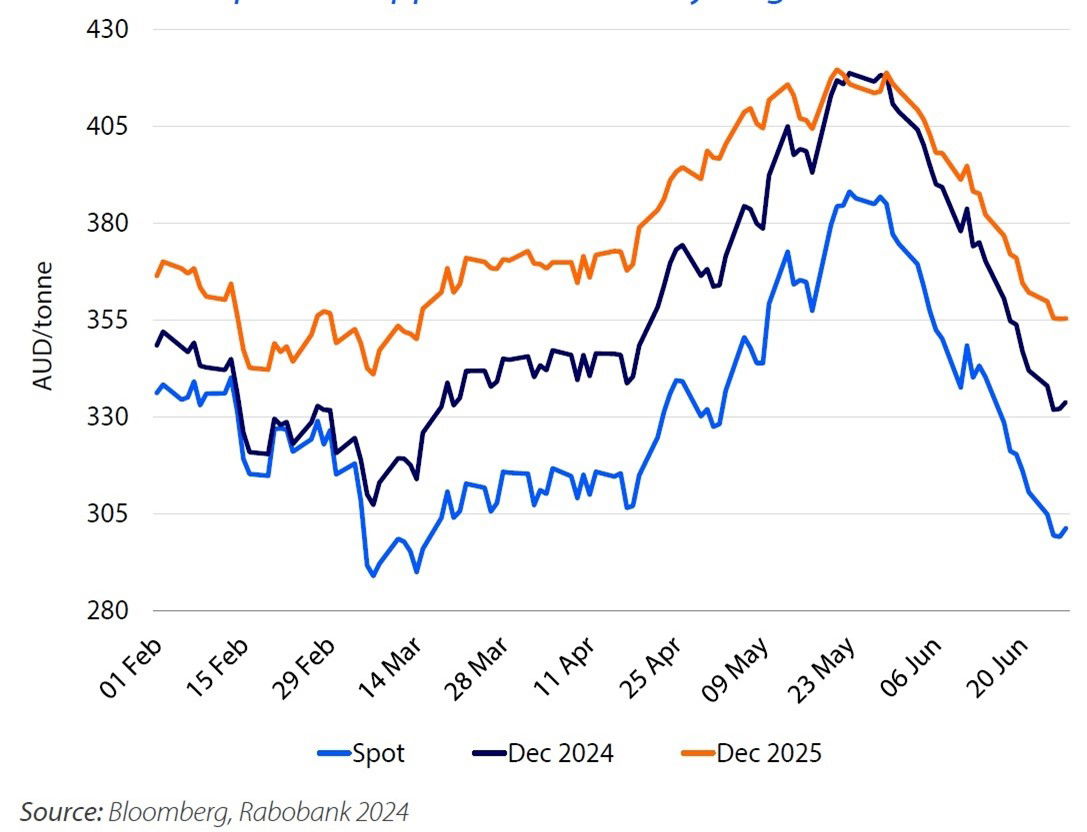

Wheat prices went on a rollercoaster ride last month, hitting a peak in late May, before tumbling just as fast as they rose.

Here's a chart compiled by Rabobank grain analyst Vitor Pistoia that illustrates the rise and fall in Aussie dollars per tonne (I'll spare you the US cents per bushel!).

Mr Pistoia says when you combine this info, with the forecasts for Australian wheat production, it's good news for Aussie growers:

"The primary reason for such a downward correction is that yield losses due to weather in Russia are not as big as initially expected," he said in the latest Rabobank monthly agribusiness update.

Numbers emerging from the US harvest are better than expected, and Canadian soil moisture is also recovering from winter drought conditions.

But there's still a forecast shortage of grain.

"Despite all the changes in crop statuses in recent weeks, we are heading to the fifth consecutive year of net deficit in global wheat supply compared to demand," Mr Pistoia said.

"Rabobank expects a small upside correction in CBOT wheat prices until year-end based on this.

"ASX basis is likely to remain positive, and futures prices are expected to mirror the global market. Australia's role as an exporter following Black Sea yield issues supports this relative increase".

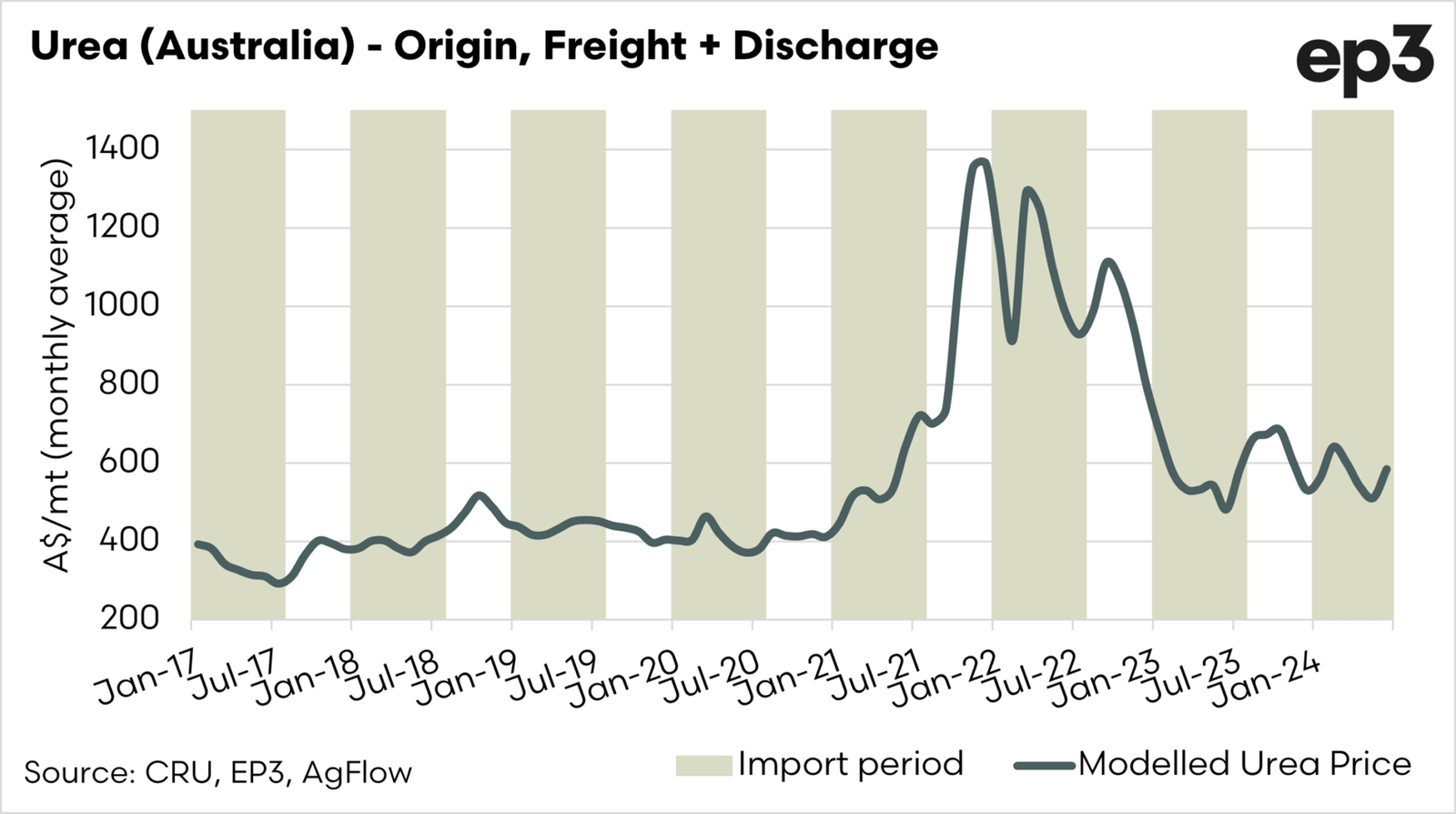

Fertiliser prices ease

By Clint Jasper

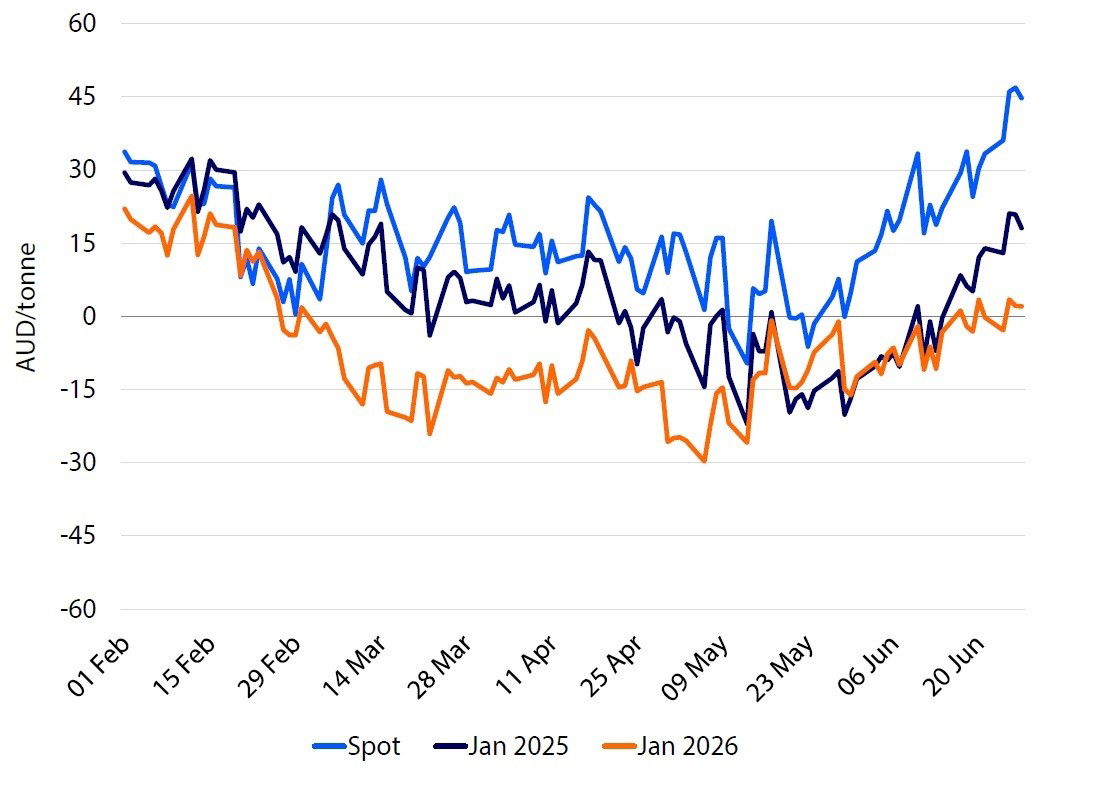

It's the biggest cost for grain growers, and thankfully for many it's getting cheaper each season.

After a big spike just after Russia invaded Ukraine, prices — as modelled by Episode 3 analyst Andrew Whitelaw — are continuing to ease.

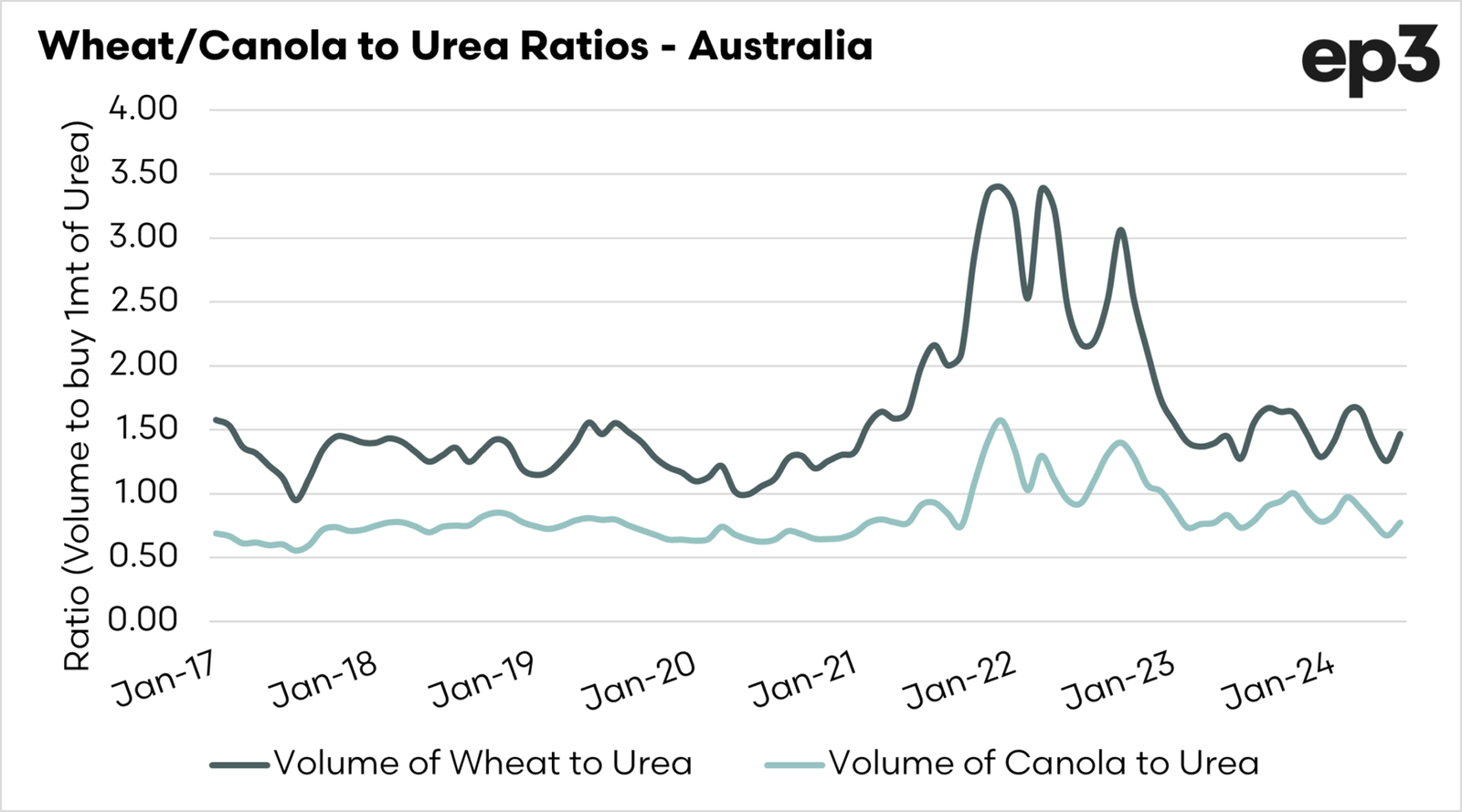

There's another more interesting aspect (imo!) that Episode 3 has visualised, and that's the "affordability" of urea.

"This chart represents how many tonnes of wheat or canola you must sell to purchase 1 tonne of urea," Whitelaw said.

"The affordability of urea has dropped back to long-term average levels. This is due to the falling urea price and the relatively higher grain prices."

The latest ABARES Crop report estimated a 9 per cent rise in winter crop production to 51.3 million tonnes.

"This is 9% above the 10-year average to 2023–24 of 47 million tonnes, and, if realised, would be the fifth highest on record."

As with everything in ag — just add water! (but not too much, nor too little).

Watch Nassim Khadem's report on the ASIC inquiry

By Clint Jasper

A 20-month Senate inquiry has found Australia's corporate watchdog ASIC has a rotten culture and that's led to Australia becoming a haven for white-collar crime.

The inquiry recommends it be split up to create a corporations regulator that looks into insider trading issues, and a financial services regulator that hears consumer complaints.

Both bodies would need to ramp up the number of cases they investigate after the inquiry heard only about 1 per cent of reports are looked into.

A new public register would be set up detailing how many civil and criminal cases have been pursued and whistleblowers would be given a financial reward or compensation for reporting misconduct.

The Committee chair, Andrew Bragg, says it's unlikely the recommendations will be adopted in this term of government, but that there needs to be an overhaul so that more cases are taken to court and consumers are better protected against financial misconduct.

Australia spy agency moves intelligence data to cloud in Amazon deal

By Clint Jasper

Via Reuters: Australia will move its top secret intelligence data to the cloud under a $2 billion deal with Amazon Web Services that Defence Minister Richard Marles said would boost defence force interoperability with the United States.

The director-general of the Australian Signals Directorate, Rachel Noble, said the national security agency would also increase its use of artificial intelligence (AI) to analyse data under the shift, which would see top secret data centres built in Australia.

"Artificial intelligence is an important game changer for all of us in the intelligence community, and we are working to embrace the use of it in an ethical, well governed and well understood manner, where we understand very carefully when we bring AI tools into our environment how are they being used, what are they doing to the data, and do we understand how carefully they need to be governed?" Noble said in Canberra on Thursday.

The move to cloud services run by Amazon Web Services, using distributed, purpose-built facilities, would give greater resilience to data used to support the defence force, Marles said.

"If one server goes down you are still able to operate," he said. "This is what will ensure we have a common computing operating environment with the United States defence forces in the future."

EV trade war

By Clint Jasper

So EVs are still selling well, despite the nonsense saying otherwise

- Ian

EVs are gaining popularity in Australia, and, for better or worse, we don't have an auto industry to protect, so the floodgates are open for which ever company wants to sell them.

This is in contrast to the USA, EU (and potentially soon Canada), where they've take steps to limit the competitiveness of Chinese-owned EV brands with tariffs (USA = 100%, EU up to 48%).

Not all brands are thriving, however. Bloomberg had an interesting piece the other day about the woes besetting Swedish manufacturer Polestar.

Polestar posted a US$232 million operating loss in the three months to March.

The brand was once a part of Volvo, but it was spun out two years ago, but lagging sales mean it's burning through cash.

Interestingly ... any guesses where most of Polestars manufacturing is? China of course. Although it won't be impacted by the tariffs, which do apply to brands like BYD.

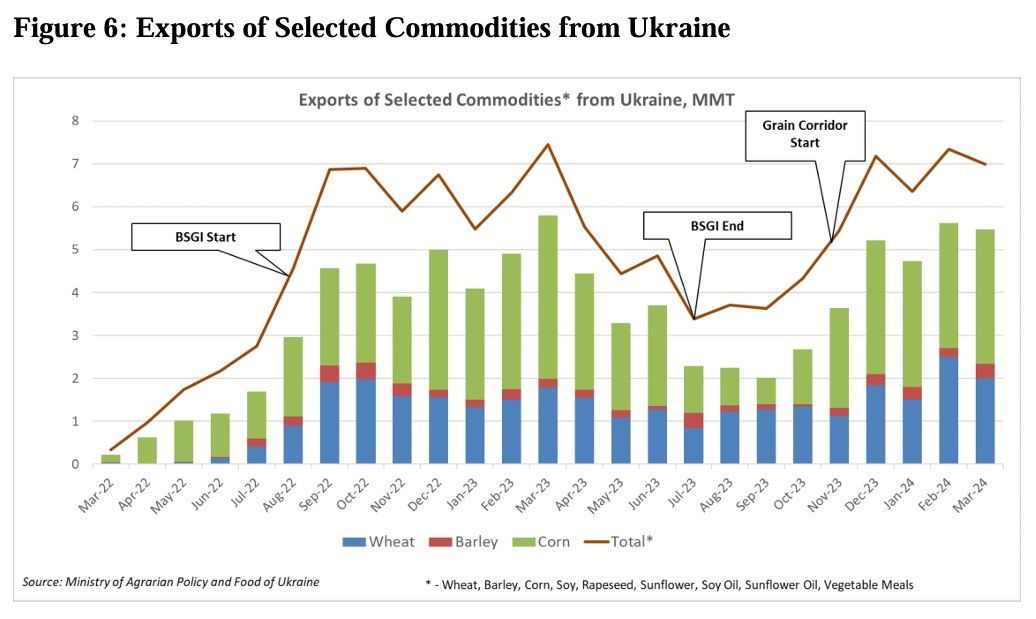

Ukrainian exporters hit back at minimum price ruling

By Clint Jasper

A new law has been signed in Ukraine that sets minimum prices for grain exports, but one group isn’t happy about it.

The president of the Ukrainian Grain Exporters Association, Nikaolai Gorbachev, has raised concerns the new law will could make Ukrainain exports uncompetitive.

The new regime sets a monthly export minimum price for each crop.

We, as a community [of the] Ukrainian Grain Association do not support this type of regulation, as we see in them (regulations) additional risks and potential problems for all grain market participants,” Mr Gorbachev said on Facebook.

“We are proud of the high level of competition and liberal rules that allow us, as a country, to increase both production and exports from year to year.”

“I am sure that the competition between a large number of buyers has created and continues to maintain the liquidity of grain products in our native country.”

Recent forecasts from the United States Department of Agriculture estimated production and export of grain from Ukraine would decrease over the coming year, because of the on-going war and decreased planting area.

The EU has become the main market for Ukrainian grain exports.

I had the chance to sit down with Mr Gorbachev for Landline in 2022, just after the ‘grain corridor’ was announced.

I haven't had enough coffee, OK

By Emilia Terzon

"Some analysts don't expect the RBA to start cutting now until early 2024," - I hope you mean 2025. Waiting for a calendar reset could take centuries.

- Cameron

Thanks everybody for noting my typo. Although not cutting rates until 2024 would be on par for the year of no moves that was!

ASX going strong in early trade

By Emilia Terzon

ASX 200 is up 1.1% to 7,822.00 points.

All 11 sectors are higher today along with the S&P/ASX 200 Index. Materials is the best performing sector, gaining +1.87% and +2.42% for the past five days.

Federal Reserve meeting notes released on rates outlook

By Emilia Terzon

They show the US central bank's board is noting that inflation is easing, but still not enough to lower rates.

Some central banks in Europe have started cutting rates, but the Federal Reserve and Austalia's RBA are standing firm.

Some analysts don't expect the RBA to start cutting now until early 2025, with some even not ruling out a hike.

Visa fee rise hitting international student market

By Emilia Terzon

A steep hike in student visa fees has pushed some potential and current international students to reconsider studying in Australia.

From July 1, the international student visa application fee more than doubled from $710 to $1,600.

How MCoBeauty dupes products, an explainer

By Emilia Terzon

This from our self-confessed beauty reporter, Kate Ainsworth, who knows more about cosmetics than any other ABC reporter.

Why is Tesla's stock rising?

By Emilia Terzon

It appears to come down to a report about its production deliveries.

The EV maker has reported 443,956 vehicles in the second quarter, with total production at 410,831 vehicles over the period. Analysts were expecting a lower number.

In a Tuesday note, Citi analysts said they anticipated a “favourable share price reaction” following the release.